UBA Ghana records a 36% growth in its balance sheet for 2021

The United Bank of Africa (Ghana) has posted a significant growth in its balance sheet for the 2021 financial year.

The United Bank of Africa (Ghana) has posted a significant growth in its balance sheet for the 2021 financial year.

According to the bank, the growth represented 36% of its balance sheet which moved from GHS3.95 million in 2020 to GHS5.37 million in 2021.

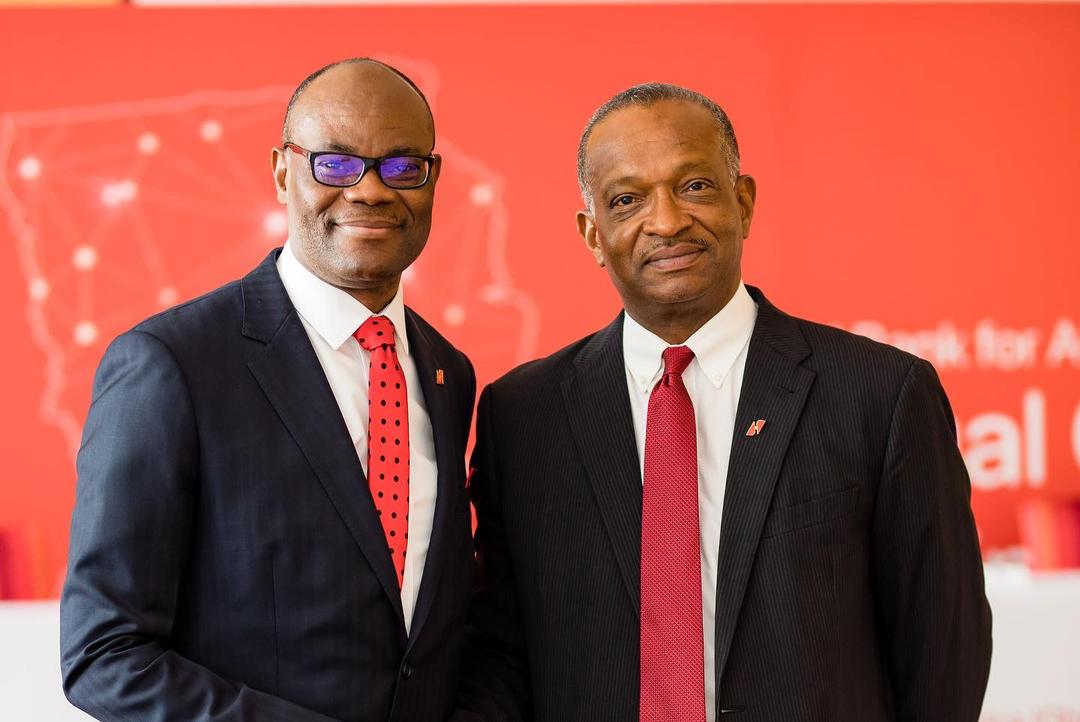

This was disclosed by the Managing Director of the bank, Chris Ofikulu at the 2021 annual general meeting (AGM) in Accra.

He said despite the macroeconomic volatility in the global and national environment, the bank posted a modest performance in 2021.

“The bank grew customer deposits of GH¢4.1 billion in 2021, up from the GH¢2.8 billion posted in 2020.”

“Overall, the bank closed the year with a significant growth of 36 per cent of its balance sheet from GH¢3.95 million in 2020 to GH¢5.37 million in 2021.”

Mr. Ofikulu said despite a drop in the banks annual profit in 2021, there was a significant growth in their operating income for the same year.

"Below the operating line, we have payments from transactions we handled ten years ago when the economy faced some challenges with oil trading, so we are here to do provision for them as directed by Bank of Ghana (BoG)" adding "but it will be recovered".

"Customers have realized that our platform is one of the best and they are happy doing business with us" he noted.

The Chairman of the Board of Directors at the bank, Kweku Andoh Awotwi, said during the year under review, Consortium Investment Trust (CIT), a Shareholder of the bank entered into an agreement with Teachers’ Fund another shareholder, where CIT sold all its shares in UBA Ghana to Teachers’ Fund.

He said the transaction received the concurrence of the majority shareholder, UBA Pic, and the company secretariat has been directed by the board to affect the necessary regulatory filings and amend the share register of the bank to reflect the new shareholding structure.