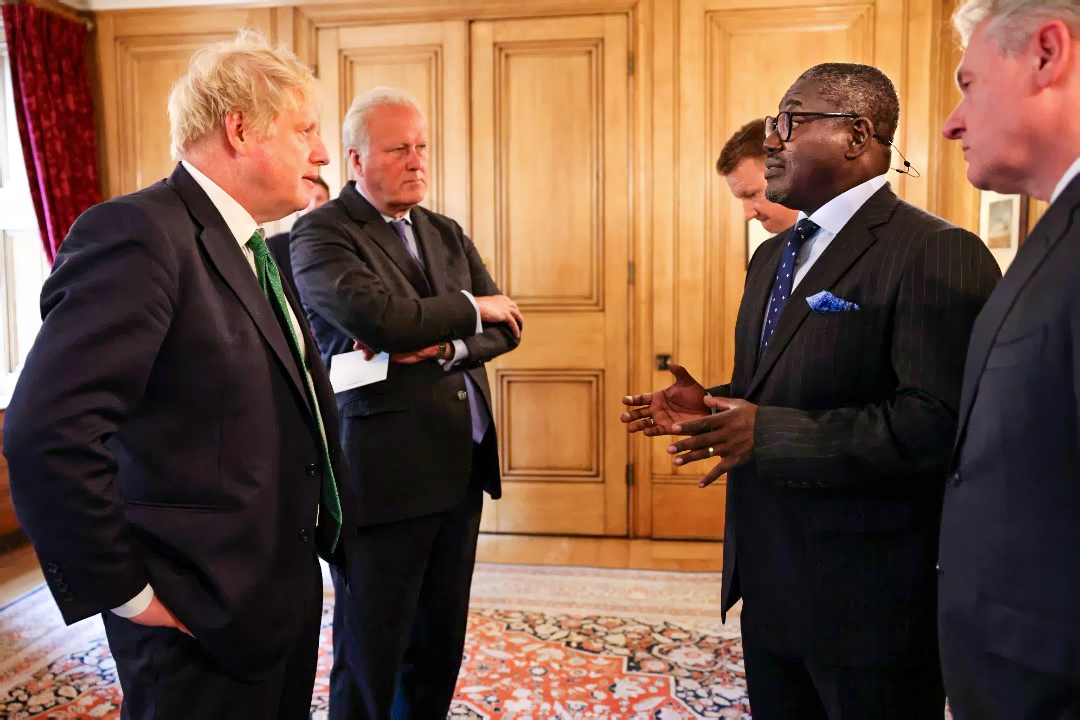

CBF 2022: CBG MD Daniel Addo meets British Prime Minister Boris Johnson

The Managing Director of Consolidated Bank Ghana (CBG), Daniel Addo has met the British Prime Minister Boris Johnson ahead of this year’s Commonwealth Business Forum.

The Managing Director of Consolidated Bank Ghana (CBG), Daniel Addo has met the British Prime Minister Boris Johnson ahead of this year’s Commonwealth Business Forum.

The meeting was organized by the Commonwealth Enterprise and Investment Council (CWEIC) to launch the CBF 2022.

In the meeting at No.10 Downing Street, the British Prime Minister lauded the Commonwealth Business Forum and its impact on African economies.

Mr. Addo who is a member of the Global Advisory Council of CWEIC, indicated that it was critical for CWEIC to meet and align with the Prime Minister on the expected outcomes from the forum.

As part of a one-on-one brief with the Prime Minister, Mr. Addo spoke about the relevance of the Commonwealth and the opportunity available for itsmembers to leverage its global presence to facilitate and foster trade and investments. He also spoke about the AFCTA, its potential to accelerate Intra-Africantrade, and CBG’s strategic focus on facilitating trade in West Africa.

The CWEIC meetings are highly patronized by the 54 countries that make up the Commonwealth including the United Kingdom.

The 2018 edition was a three-day event with more than 40 individual sessions in three iconic London locations. 1400 participants from 80 nations took part representing businesses, regulators, trade and investment promotion bodies, and Governments.

CBG recently announced that it is expanding its Small and Medium-sized Enterprises (SME) capabilities by partnering with the new Development Bank Ghana (DBG) to deliver technical and financial support to the sector.

Speaking to a section of the media on CBG’s agenda for SMEs this year, Mr Addo indicated that CBG had over the years delivered extensive support to SMEs and was keen on expanding its capabilities in the sector to tap into the opportunities that exist and to ensure an improved contribution from the SME sector to the economy of the country.

According to him, “we have approached this in a holistic manner and it is just not to fund SMEs but to take the entire SME value chain and see how we can support businesses to operate more efficiently by unlocking cash that is trapped in receivables, facilitate collection for SMEs and importantly build capacity in the SME space.”

“We have done that through the products that we have rolled out and through the technology platforms that we have established. This allows SMEs to collect money through their mobile wallet and make deposits via mobile tellers deployed in the markets to collect cash from SMEs,” he said.